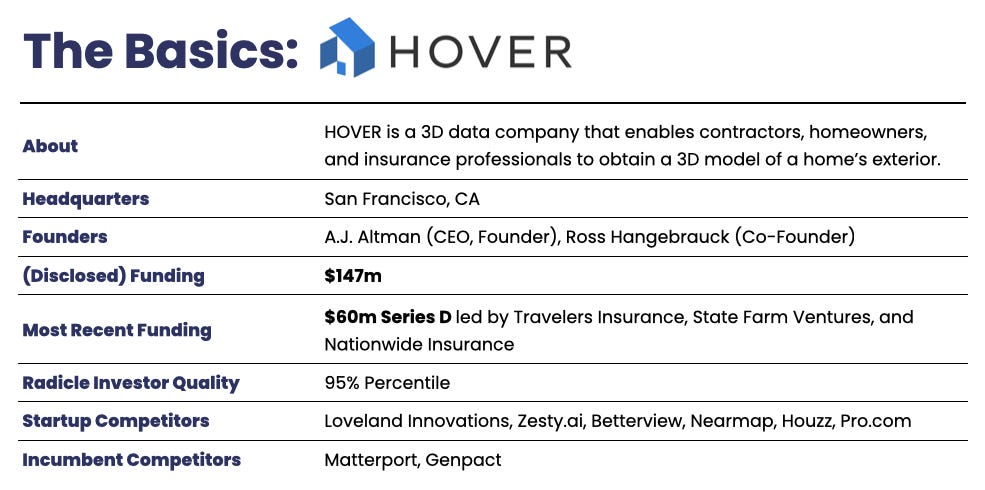

Will HOVER become the next Matterport?

How 3D modeling is bringing innovation to insurance carriers

Welcome to The Future State: Insurance where we profile the startups rewriting the future of insurance. If you like what you read, subscribe here:

The insurance industry was promised ‘innovation’ and the home insurance industry may have gotten just that in 3D home modeling startup HOVER – which raised a $60m Series D from an onslaught of CVCs including insurance behemoths Nationwide, State Farm, and Travelers (along with Guidewire and Standard Industries).

While in the D2C markets, innovations almost always revolve around how-to-better-sell insurance. In the case of HOVER, we have an example of a new tech that not only helps insurers do their job better but unlocks new opportunities for the carriers.

Innovation for insurance carriers isn’t about reinventing the wheel, it’s about greasing the wheel. Building tools and automation to lower loss ratios, lower expense ratios, and/or improve customer satisfaction. When it comes to home insurance claims and HOVER, imagine turning the previously manual process of measuring a house into a nearly automated process (with just 8 photos). Reduce human error, speed up the adjuster’s job, and provide a streamlined digital experience for customers that gets claims dollars into their pockets faster.

Matterport was able to build a $2b business modeling the interior of the home. Can HOVER achieve something similar with the exterior?

Problem

The exterior of the home is where the bulk of the damages occur. Yet, adjudicating home exterior claims takes literal man-hours. Moreover, home insurance underwriters often work from out-of-date property records resulting in potential hazard misses.

When it comes to underwriting home insurance and exterior claims, insurance carriers still operate via manual and legacy processes.

It’s important to us that we provide our customers with the best possible experience, and HOVER’s technology helps us to do that by creating a simpler, faster and more transparent claims process. (Nick Seminara, Executive VP and Chief Claims Officer, Travelers)

Handling exterior damage claims is manual and takes literal man-hours.

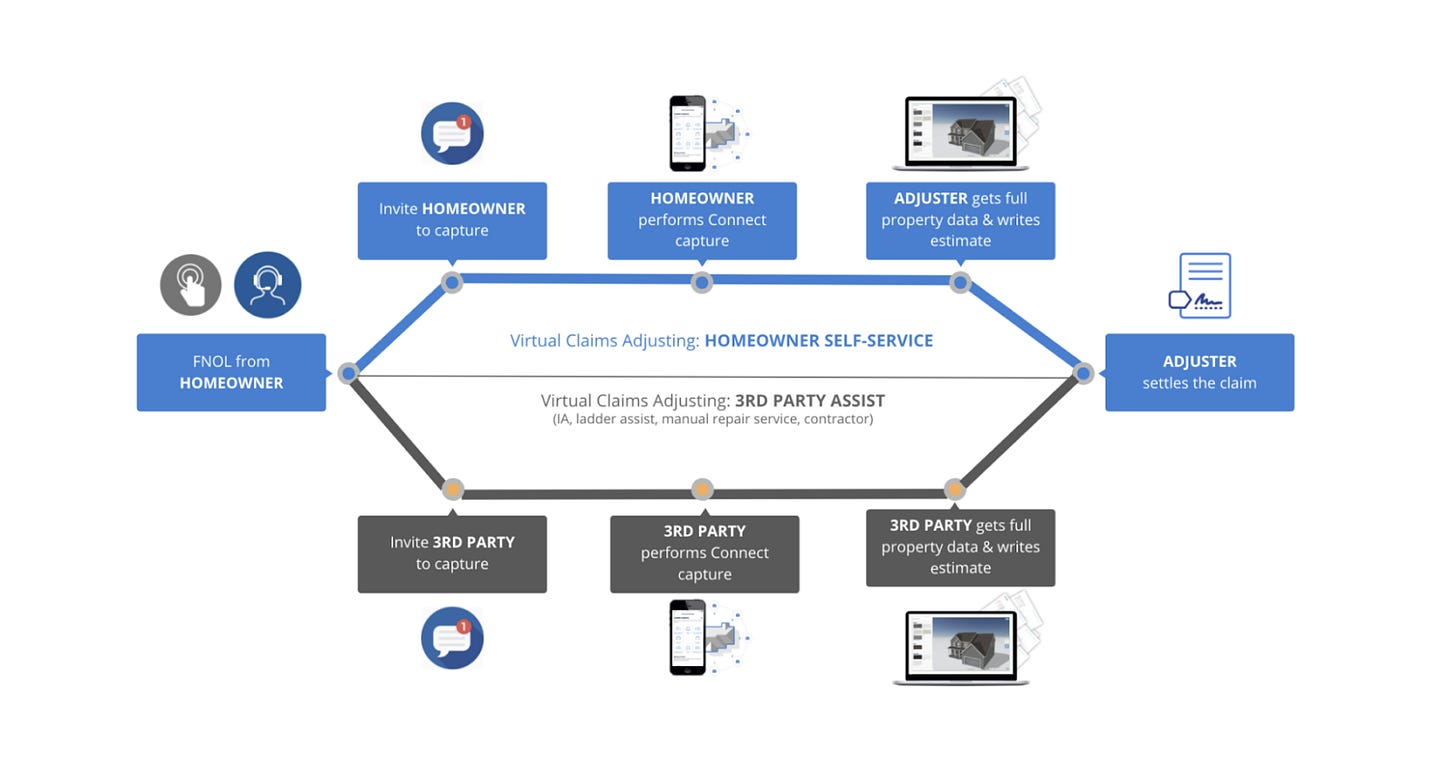

When a homeowner files an exterior claim, after the first notice of loss (FNOL), a regional adjuster makes contact with that homeowner, schedules an onsite, visits the site, validates the damage, scopes and measures the damage, and then finally determines the settlement.

This process – which occurs over the span of a few days – costs carriers $350 to $500 per claim. When there are ~2.3 million exterior claims per year, that totals to ~$1.2b in loss adjustment expenses.

Moreover, inaccurate measurements can result in unexpected future losses. If you can be 2% more accurate than traditional measurement methods, that would save $160+ per claim. Across 50k claims, that would total to $8m in leakage.

Property visuals and records used for underwriting are often not up-to-date.

If you’re using tax records or aerial imagery, you might not see that there’s been an addition to the property or hazards around the property. (Spencer Warden, Sr. Director of Enterprise Sales & Strategic Partnerships, HOVER)

When underwriting a property, insurers need to know what’s going on in and around the structure so that their insurance-to-value ratio is accurate (that is, the coverage properly reflects the property’s replacement costs). ~60% of homes in the U.S. are underinsured (by an average of 22%).

Often, after a policy is purchased, insurers will send properties to get inspected – though, insurers don’t want to bear that cost so they supplement the process as much data as possible. This applies not just to new policies but also renewals. For assessing exteriors, underwriters rely on appraisals, government property assessments (which happen once a year), and aerial imagery (which is updated on a once-every-other-year basis). Missing hazards can directly impact an underwriter’s loss ratio.

Moreover, to sound like a broken record: insurance companies are always looking to improve their accuracy, improve their claims processes, and become better service providers – especially in a world relying more and more on telecommunications, consumers expect digital experiences from their providers. As I write more and more of these posts, the same problems always arise (which may justify a full post to each of the common problems and how they’re being solved).

Solution

HOVER is a 3D data company that enables contractors, homeowners, and insurance professionals to obtain a 3D model of their home’s exterior with just 8 photos for the purpose of home improvement, restoration projects, and claims adjudication. HOVER’s 3D models provide consistent and accurate measurements, up-to-date and real-time data, and can enable carriers to inspect more renewals.

We’re helping to reduce cycle times and bring transparency to the claims handling process. With regard to underwriting, we’re helping bring up-to-date measured and accurate information about a property to help with the risk assessment and pricing of that property. (Spencer Warden, Sr. Director of Enterprise Sales & Strategic Partnerships, HOVER)

HOVER is very much a tech-first, use-case later type of company. The solution actually spawned out of a DoD use-case before moving into the home exteriors markets (if you can map a building, you can train teams on how to infiltrate them). Before diving into the insurance use-cases, let’s talk a bit about how the tech actually works:

Leveraging smartphones, anyone can take 8 photos at different vantage points surrounding a building (imagine taking photos at each corner of an octagon). Leveraging computer vision and deep learning, HOVER’s servers develop and return a 3D model of that building with exact measurements. Users can then review the measurements, export that data, further augment and design the model, and order materials directly from distributors.

HOVER measures the entire exterior of the home including roof measurements, facades, gutters, and openings – as well as, being able to take stock of any external damage.

At the core of HOVER’s technology is being able to quickly and efficiently communicate home data across multiple parties. In the insurance context, HOVER helps carriers address 2 primary areas:

Claims

As noted above, exterior claims require onsite adjusters to validate the damage. With HOVER, insurance carriers can involve the property owner to upload a HOVER model where then the adjuster can initially assess the damage from their desk. This process won’t completely replace the onsite visit – though it does help reduce loss adjusted expenses by taking out the need for hand measurement, increasing efficiency for the adjusters in the process. In theory, HOVER’s virtual solution enables claims adjusters to be able to handle 5-6 claims per day instead of the standard 1-3 claims per day. Moreover, if there’s a model already on file, insurance carriers can easily settle damage claims by having that point of reference.

Underwriting:

While historical data can miss changes to a property, having a model upfront during the underwriting process can ensure whether new additions were built or if there are new hazards. The HOVER solution allows for more property inspections to be completed, at a much faster pace.

Though interestingly, by reducing the friction to get an exterior measurement, HOVER, in theory, unlocks the potential for carriers to inspect more homes for underwriting purposes.

When it comes to customer satisfaction, incumbents struggle with retention and by helping speed up the claims cycle time, HOVER is helping increase customer satisfaction (leading to better retention). It’s hard enough to get an insurance NPS score to budge 1% –– HOVER is helping insurance carriers boost their NPS scores by double digit numbers.

Lastly, it’s worth noting, carriers can often have siloed Claims and Underwriting departments where sharing data can be very difficult. By digitizing the footprint of the home, HOVER enables departments to more easily share data across departments.

Business Model and U.S. Market Size

First, to caveat this section, we are only looking at HOVER’s insurance business lines and not their business lines when it comes to home contractors and restoration professionals. While typically in these posts, we engage in some valuation math –– though, for HOVER, since we’re not looking at HOVER’s other business lines, it’d be imprudent to do a full analysis1.

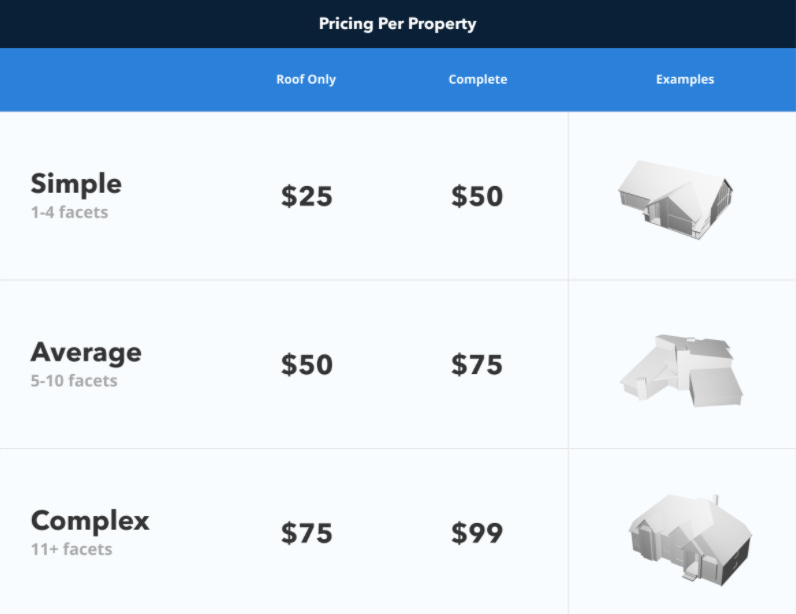

HOVER’s business model helps us with the basis of our math. HOVER uses a transaction-based model, charging per model generated. Pricing differentiates based on the number of roof facets (the # of planes on a roof):

Importantly, when it comes to HOVER’s business model, they also offer a membership plan unlocking additional features, which helps with revenue predictability.

When looking at the market for where HOVER’s tech falls in the insurance value chain, we look at two places: (1) the # of exterior claims filed per year and (2) the number of home insurance policies written each year. Moreover, HOVER serves more than just the residential market, they also serve the commercial markets – though here, for our estimates, we focus on the residential market.

For the residential market, we look at single-family homes (~83.5 million homes in the U.S.). For claims, we’re going to assume that the typical home falls into the “Average” category and homeowners are getting the complete model at $75. For underwriting, HOVER charges ~$20 per model (here, all that is needed is the total area living sketch while claims require a more in-depth and detailed property measurement output).

On the claims side, HOVER’s business could generate $171m in the U.S.

About 85% of homeowners have insurance, reducing the property pool down to 71 million (though, nowadays most lenders require home insurance for mortgages). When there are ~5.6 claims per 100 policies filed each year, we’d be looking at 4 million home insurance claims per year.

However, HOVER doesn’t extend to all home claims, only that of the exterior. For that, we look at fire and lightning, wind and hail, and other extraneous exterior acts – which totals to 3.22 claims per 100 policies. This would suggest a total of 2.3 million exterior claims filed per year and a total of $171m in potential 3D modeling fees.

On the underwriting side, HOVER’s business could generate $231m in the U.S.

For underwriting, we look at home sales and renewals. For home sales, in 2020, there were 6.4 million home sales (5.6 million existing home sales and 811,000 new home sales). At $20 per model, that could generate up to $128m in total transactions per year. Though not all policies sold will require additional inspection. Assuming that the 60%2 of under-insured homes extends here, that revenue volume would fall to $77m.

For renewals, let’s assume that 10% of renewals are inspected. Subtracting existing and new home sales, 10% of the remainder would be 7.7 million homes that would have their renewals inspected. At $20 per model, that’d be $154m in potential revenue –– summing to $231m in total potential revenue.

If HOVER does speed up the time for inspect properties, we could see that 10% of renewals grow to something more significant, further expanding this market segment.

HOVER’s initial GTM in the insurance market was with their Claims product, but the Underwriting output has quickly started to gain traction. For the insurance business lines, three clear places of expansion would be:

Geography: HOVER’s initial set of insurance customers are U.S.-based and the above analysis is restricted to the U.S. market. Yet, HOVER’s technology is not restricted to the U.S. which would be a significant source of revenue expansion. Clear markets for expansion would be the U.K., Denmark, Germany, France, and Australia when looking at total P&C claims paid out yearly.

(Small) commercial buildings: While HOVER primarily serves the residential claims market, it’s possible for their tech to expand to commercial properties. HOVER already serves small commercial buildings like churches and gas stations.

Interior claims: The goal for HOVER would be to handle all damage-related claims (close to 98% of all claims), which would expand the TAM by at least 2x. While the business model for interior claims is undefined, HOVER could charge per room (as modeling 10+ rooms would require much more than just 8 photos). By branching into interior modeling, HOVER would not only increase their claims revenue but provide a more compelling property inspection solution.

A (U.S.) TAM of $402m is not a sizable market alone, which is why we see HOVER (as well as its core competitors like Matterport, Loveland Innovations, and Zesty.ai) do more than just insurance claims. While HOVER is initially rooted in the home contractor market, Zesty.ai, for example, which leverages aerial imagery, also offers climate risk modeling and portfolio monitoring.

While this analysis glances over HOVER’s home improvement and remodeling business lines, at the end of the day, HOVER is about bringing efficiency to the insurance industry and helping insurers be better service providers. HOVER enables incumbents to better compete with insurtechs on customer experience, at least in the short term. These tools will be commoditized across the industry sooner or later - helping eliminate historically wasteful spending and likely translating to lower (though incremental) premiums. HOVER has the potential to make an already competitive market even more competitive.

Did you like what you read? Please share! 😊

In case you missed our previous posts:

Upcoming Posts (released every other week, in order):

Corvus Insurance on using AI to better underwrite commercial cyber, E&O, and cargo insurance. Corvus ranked #6 among Series C and later startups. Corvus recently raised a $100m Series C from Insight Partners.

Wrapbook on embedding entertainment production insurance and workers comp into payroll software. Wrapbook is the top ranked Series A companies by our Investor Signal score, having raised a $27m round led by a16z.

If you consider Matterport’s SPAC, which is listing at a ~27x revenue multiple, HOVER would only need to generate ~$37m in revenues to achieve a $1b valuation. In the long-run, this multiple is likely much smaller as it’s accounting for presumed growth. Moreover, HOVER’s business model is transaction-based and isn’t exactly recurring, so a question remains on what kind of valuation HOVER would warrant in the long run.

Though a priori, the underwriters don’t know which properties are underinsured, so this number would likely flex upwards.